July 9, 2025

Click here to watch Senator Blunt Rochester’s full exchange with the witnesses.

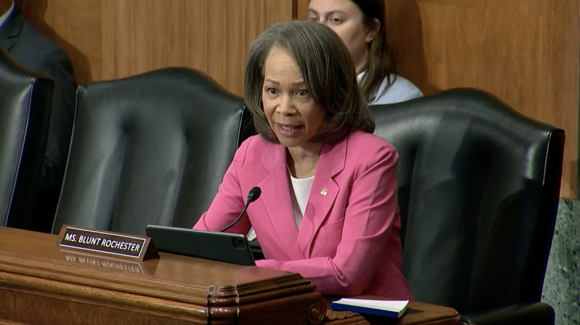

Washington, DC – Today, U.S. Senator Lisa Blunt Rochester (D-Del.), a member of the Senate Banking, Housing, and Urban Affairs Committee, participated in a hearing titled, “From Wall Street to Web3: Building Tomorrow’s Digital Asset Markets.” Blunt Rochester and her fellow committee members discussed the need for serious and sustained engagement on digital asset market structure. In her questions, Blunt Rochester asked the witnesses about producing a bipartisan framework that can earn the public’s trust and stand the test of time.

To watch the full hearing, click here. Key excerpts can be found below:

Senator Blunt Rochester: “Thank you, Mr. Chairman, and thank you to the witnesses. I really welcome this hearing and the opportunity for a serious, sustained engagement in digital asset market structure. This is enormously complex and could fundamentally reshape the bones of our economy. We have already seen what happens when digital finance grows without guardrails. The collapse of FTX, Terra Luna, and Celsius wiped out billions in consumer savings and exposed glaring regulatory gaps. When regulation lags innovation, real people get hurt. At a time of rising prices and growing wealth inequality, I am sure we can all agree that the last thing we need is to rush or have a poorly designed market structure built. And at the same time, I strongly believe in innovation. That’s why I joined Senators Moreno and Sheehy to introduce the bipartisan Deploying American Block Chains Act. And I support a bipartisan, thoughtful, transparent, and inclusive process, especially for legislation that could shape the future of U.S. capital markets. My first question is for you, Mr. Painter. What are the risks if Congress moves forward too quickly in legislating without broad input and clear understanding of market consequences? And how do we ensure that this process produces a bipartisan framework that can stand the test of time?”

Mr. Painter: “The risk is we repeat the experience of exiting the banks in the 1920’s and the depression that followed. 10 years of depression. The risk is that we repeat what happened in 2008 when campaign contributions pouring into Congress from the securities [inaudible] industry, elsewhere in the financial services industry, and we had decades of deregulation. The economy collapsed. Millions of American families losing their homes. People unemployed. We have been through this again and again…”

###

Senator Lisa Blunt Rochester represents Delaware in the United States Senate where she serves on the Committees on Banking, Housing, and Urban Affairs; Commerce, Science, and Transportation; Environment and Public Works; and Health, Education, Labor, and Pensions.